According to Gartner®, “By 2026, 75% of wealth management firms will deploy all-in-one advisor desktop platforms and increase advisor productivity by at least 25%” and “[…] 60% of wealth management firms will have developed hybrid advice capabilities, closing the gap between self-directed and traditional advice, increasing profitability by 25%.”

“The investment services industry is facing a myriad of well-known threats and challenges, exacerbated by stagnant productivity based on existing business models and the lingering challenges of legacy technology. In the future, the most successful firms will be those most prepared to manage costs, have the agility to pivot on new opportunities and are prepared to harness mega forces like AI.”

“Increasing advisor productivity and advisor capacity to support new clients using automation, analytics and AI will drive innovation focus for wealth management firms”, while we believe the service model will become more personalised based on the changing demographics of the clientele.

“The advisor-led advice model has worked well for a relatively homogeneous customer base. However, as the HNW customer base becomes more diverse, it presents an opportunity for digitally enabled and self-directed customer journeys, as well as advisor guidance.”

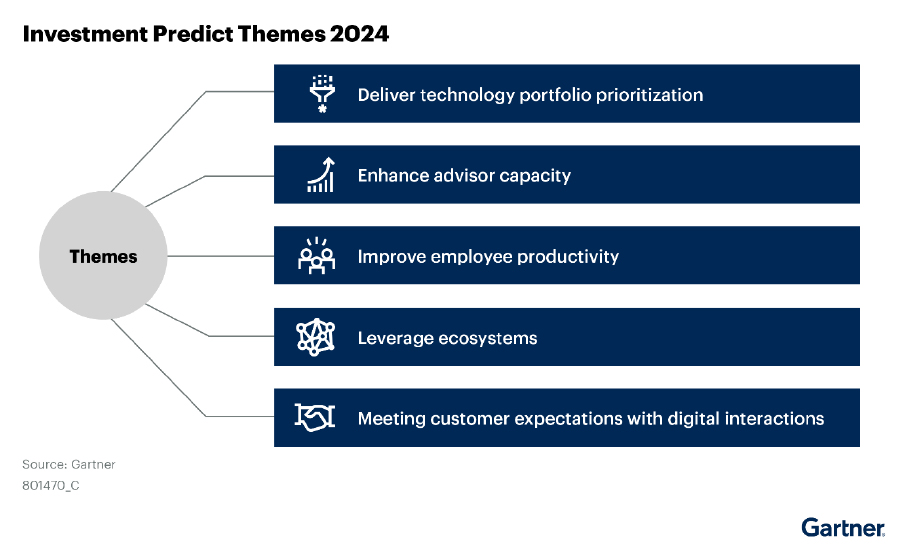

Objectway is pleased to offer you a complimentary copy of this Gartner® report, which outlines five essential predictions for business and technology leaders to navigate through the ongoing global uncertainty, addressing short-term challenges while safeguarding longer-term goals.

Don’t wait, get access to this report now before it’s too late!

Gartner®: Predicts 2024: Investment Management Drives Productivity Amid Uncertainty, Ali Merji, Chuck Thomas, 19 March 2024

GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and is used herein with permission. All rights reserved.