Sub-outsourcing to a strategic partner

BNP Paribas SA, (Italian Branch) Securities Services Division, client from 2014 – The Securities Services business line of BNP Paribas is the largest Custodian in Europe, and ranked #5 globally, providing its clients with Securities Services solutions closely integrated with the best-in-class capabilities of the Group’s other business lines. These include treasury financing and advisory, and global markets solutions.

Empowering BNP Paribas Securities Services in Italy to elevate Client Service Experience and achieve Operational Excellence.

The Securities Services division of BNP Paribas in Italy had an innovation ambition which revolved around the ability to deliver a high-quality service model for its transfer agent service seamlessly integrated with the other components of their offering.

Leveraging Objectway Business Innovation Matrix*, the solution has been delivered to adopt and execute a strategic-sourcing platform designed to offer a more cost effective target operating model improving and evolving the value proposition for BNP Paribas Securities Services’ key customers.

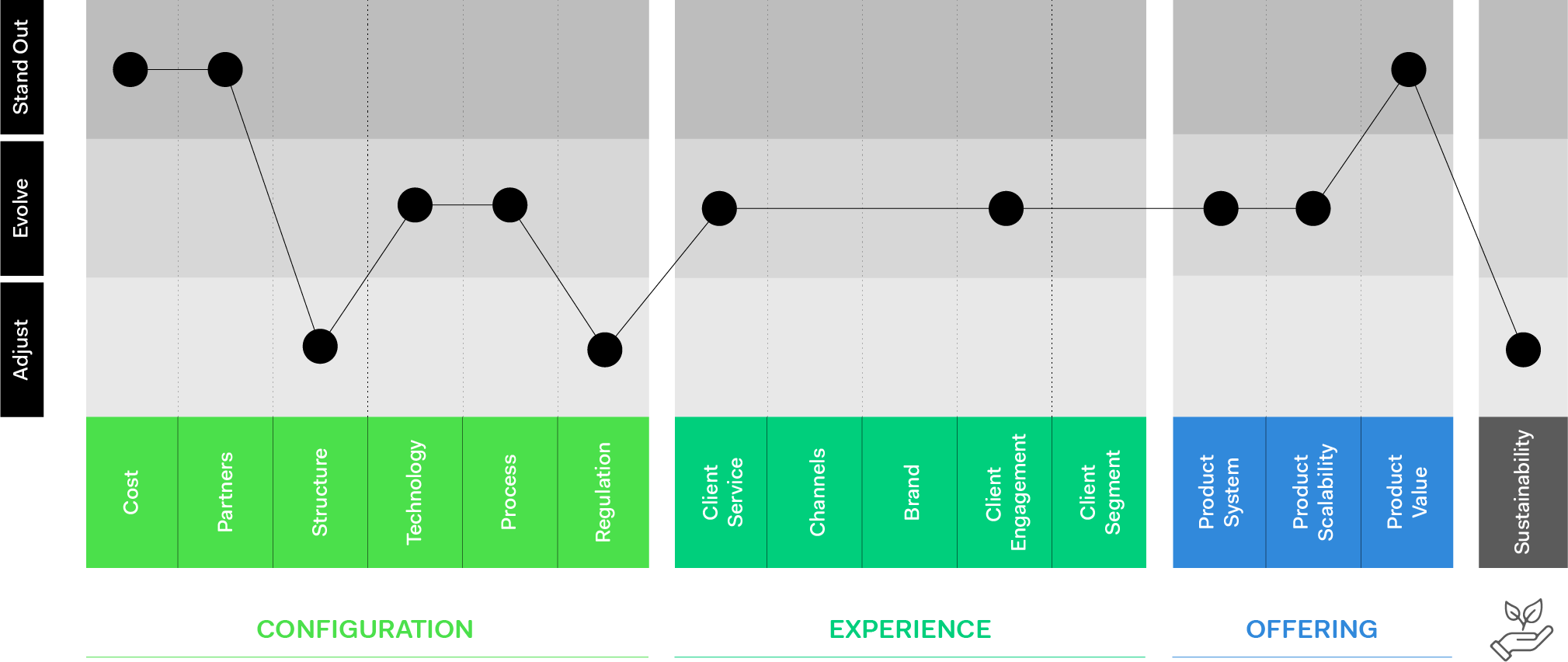

* The Business Innovation Matrix captures the areas of Value Creation (Experience, Offering, Configuration, under the umbrella of Sustainability) and how they are interconnected to generate successful and sustainable innovation across the entire value chain, that is a game changer for the firm and the end-clients.

Our client was on a mission to redesign its operating model to support a large client fund distribution. They sought to find a reputable and reliable partner capable of committing to technological evolution, service excellence, and digital security to generate a set of benefits: technology expertise, scalability of services, productivity improvements and strengthening of performance.

To achieve these objectives, the Objectway Platform was implemented, focusing on business reconfiguration, customer experience, and offering evolution. Objectway successfully delivered an offering model that ensures optimal scalability and comprehensive cost management, incorporating various best practices to enhance client service experience and engagement. This includes personalized interactions, rapid response times, streamlined processes, and continuous improvement. Moreover, it enhanced the value proposition for BNP Paribas Securities Services’ key customers.

Leveraging the Objectway Platform, know-how, experience and end-to-end delivery capabilities we have successfully delivered a tailor-made Business Process as a Service solution, designed to significantly enhance the operational efficiency of BNP Paribas’ model.

Our client is now able to focus on value-added activities, specifically those service components critical to their client experience, while outsourcing components where Objectway possesses the technological expertise to guarantee a scalable service experience. This partnership ensures benefits in terms of long-term service excellence and evolution for BNP, its clients, and investors.

Business Benefits

Maximise operational accuracy

Reduce processing times

Gain maximum flexibility and optimised scalability

Focus human intervention on value-added activities

The story with Objectway is a successful one. We started this journey together and together we will continue on our evolutionary path to improve the client experience in terms of both technology and service quality.

BNP Paribas is a multi-asset servicing specialist committed to help its clients achieve their ambitions both in terms of investments and cross-border distribution. The Securities Services division of BNP Paribas is one of largest Custodian in Europe, and ranked #5 globally, providing its clients with Securities Services solutions closely integrated with the best-in-class capabilities of the Group’s other business lines. These include treasury financing and advisory, and global markets solutions.