FEB 15, 2022

Banking Client Centricity: The Competitive Currency of 2022

MARKETING CONTENT CREATOR

Reading time: 2 min

OWINTALK | BEHIND BUSINESS, BEYOND NEWS

Companies, in every sector, have been trying to adopt customer centricity for nearly two decades. And yet, every time they believe they have reached the holy grail of competitive advantage, there they are demands and expectations changing again.

Over the last two years, largely due to the pandemic, firms in the financial services industry have questioned how they engage with clients and explored new methods to do old stuff. Some made significant progress and manufactured comprehensive digital experiences, others are still working on it. But is there time to keep thinking on how to put your client at the centre? Or the time has come to get in the game and act?

How to get Client Centricity right?

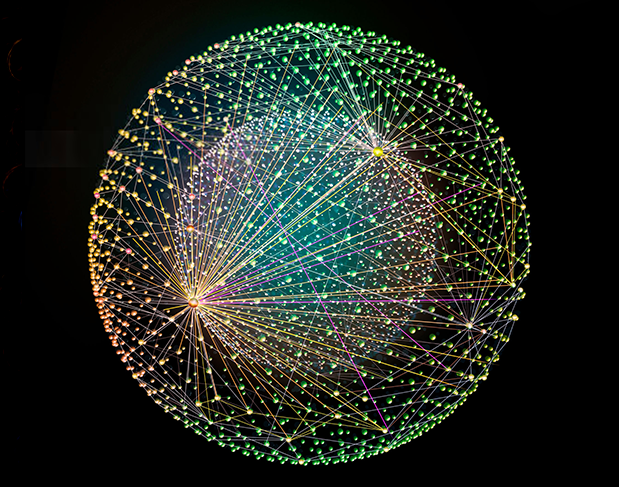

Building a banking digital experience that puts the client at the centre of the process is definitely easier said than done, and one of the major obstacles we reckon is the overwhelming volume, velocity and variety of customer data that financial institutions inevitably collect across multiple channels on a daily basis and throughout the entire customer journey.

The thing is, they are all competing in the same market, for the same target, having the same goal so there must be a keystone that counts for the ultimate differentiator in the collective assessment. Ladies and gentlemen, we’re talking about technology.

The growing attention towards digital solutions also among older generations, together with a huge part of the financial population being digital-first, lowered the attractiveness of traditional banks and favoured new banking paradigms.

Indeed, with the right technology in stock, one that enables processes and operational capabilities to target clients with tailored communication and experiences, a company can become the demiurge of the next client experience. Take a CRM system, it provides banks with a centralised database where to store customer data and build customer profiles; but also, the coming of age of super apps, that combine a plethora of financial services, being accessible all in one place, and bring advantages in terms of higher degree of integration.

Beyond technology, clints desire and will always desire benefits in terms of payments, compliant privacy policies etc. but all these benefits are worth little if not carefully customised. On their side, banks are challenged to go further than simple segmentation and create segments of one.

As a result of this, clients should perceive that the banks own a deep understating of their very unique preferences and needs: what products they personally consider the most relevant, what are the features they search for or care about the most and how existing products can meet these priorities. This, we can call it need-based design.

At a surface level, banks need to personalise communication to convey how their products meet clients’ preferences and satisfy their objectives. All this must be embedded into a solid, overall customer-centric strategy that crosses the entire operating model, meaning that the organisation must be based on a client-centric, agile, flexible way of working and is grouped under the same client-first culture.

At the end of the day, client centricity is the basis, from which banks will be able to build customer engagement and create a personal, stable, long-term relationship with clients.